Latest News

CFE’s Tax Top 5 – 26 January 2026

BRUSSELS | 26 JANUARY 2026 OECD Tax Consultation on the Global Mobility of Individuals On 20 January 2026, the OECD held its public consultation meeting on the Global Mobility of Individuals, following a submission process carried out in late 2025 as part of the OECD...

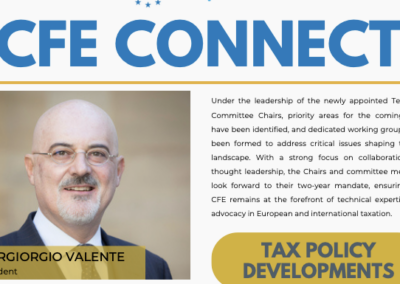

CFE Connect – December 2025

The December 2025 edition of CFE Connect is now available online. CFE Connect is designed to keep tax professionals informed of emerging policy trends and developments in European and international taxation, as well as inform our members about CFE’s ongoing...

CFE’s Global Tax 10 – December 2025

BRUSSELS | DECEMBER 2025 OECD Consultation on the Global Mobility of Individuals This month, the OECD public consultation examining the tax challenges arising from the increasing global mobility of individuals, including cross-border remote working, short-term...